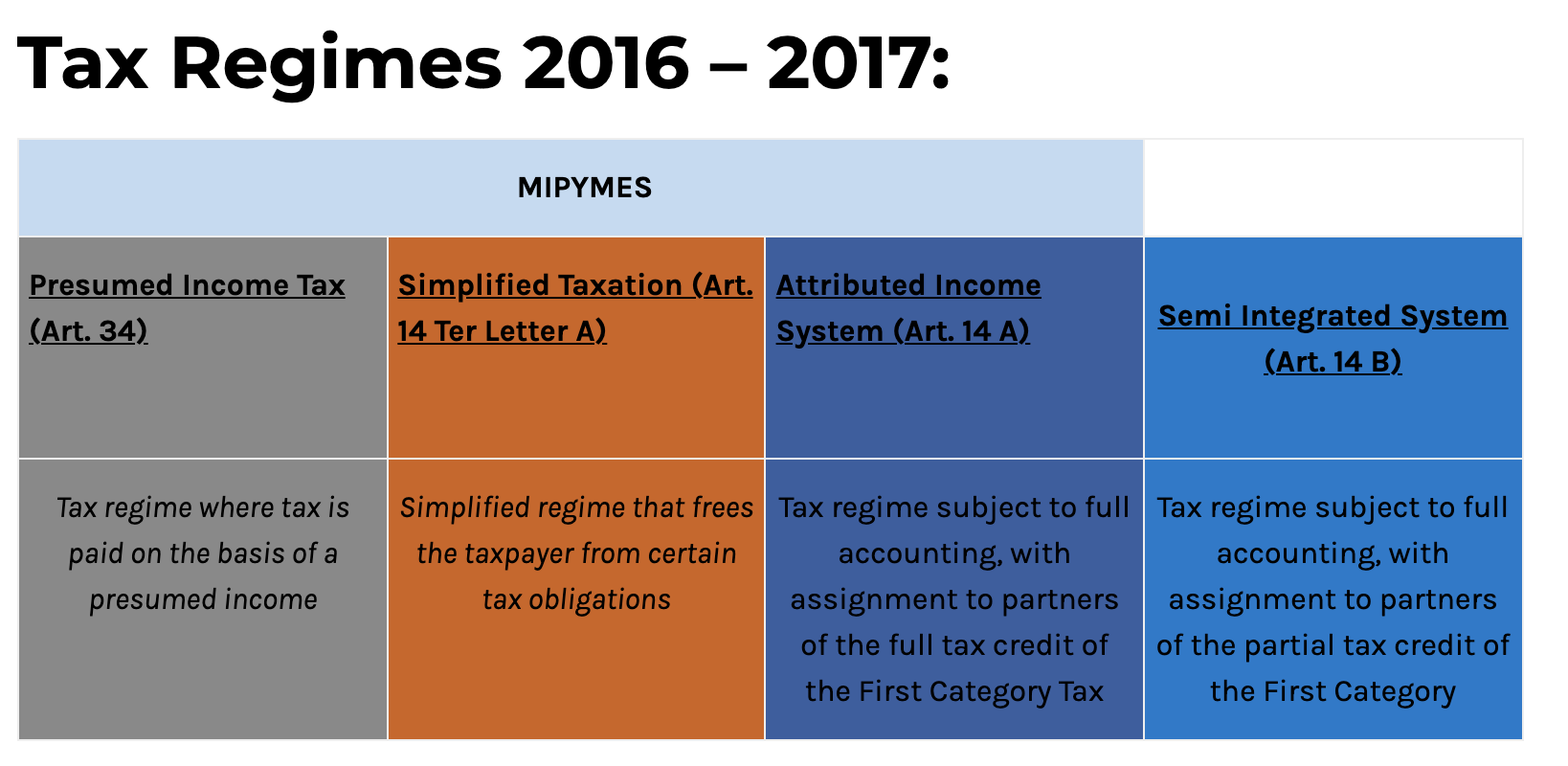

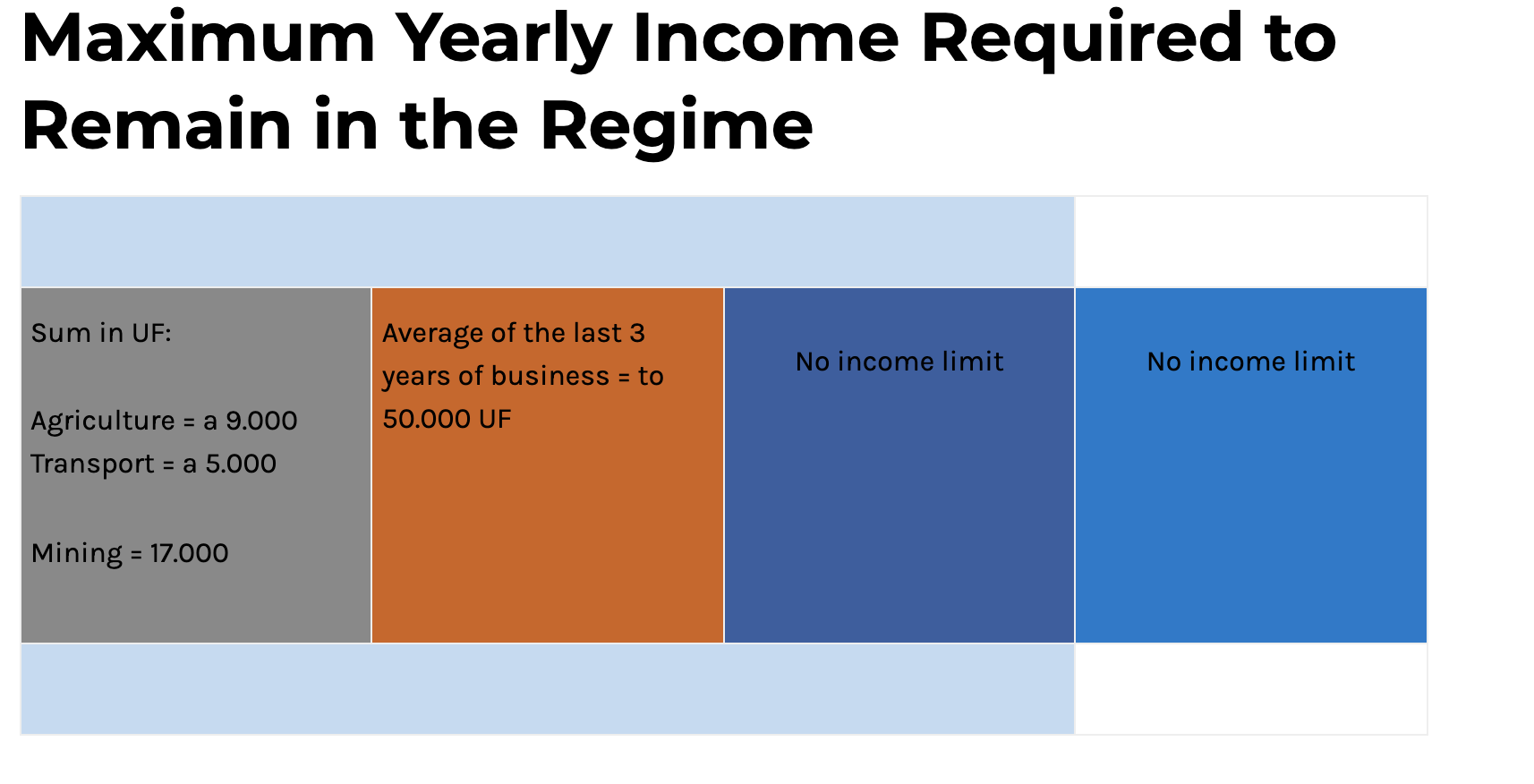

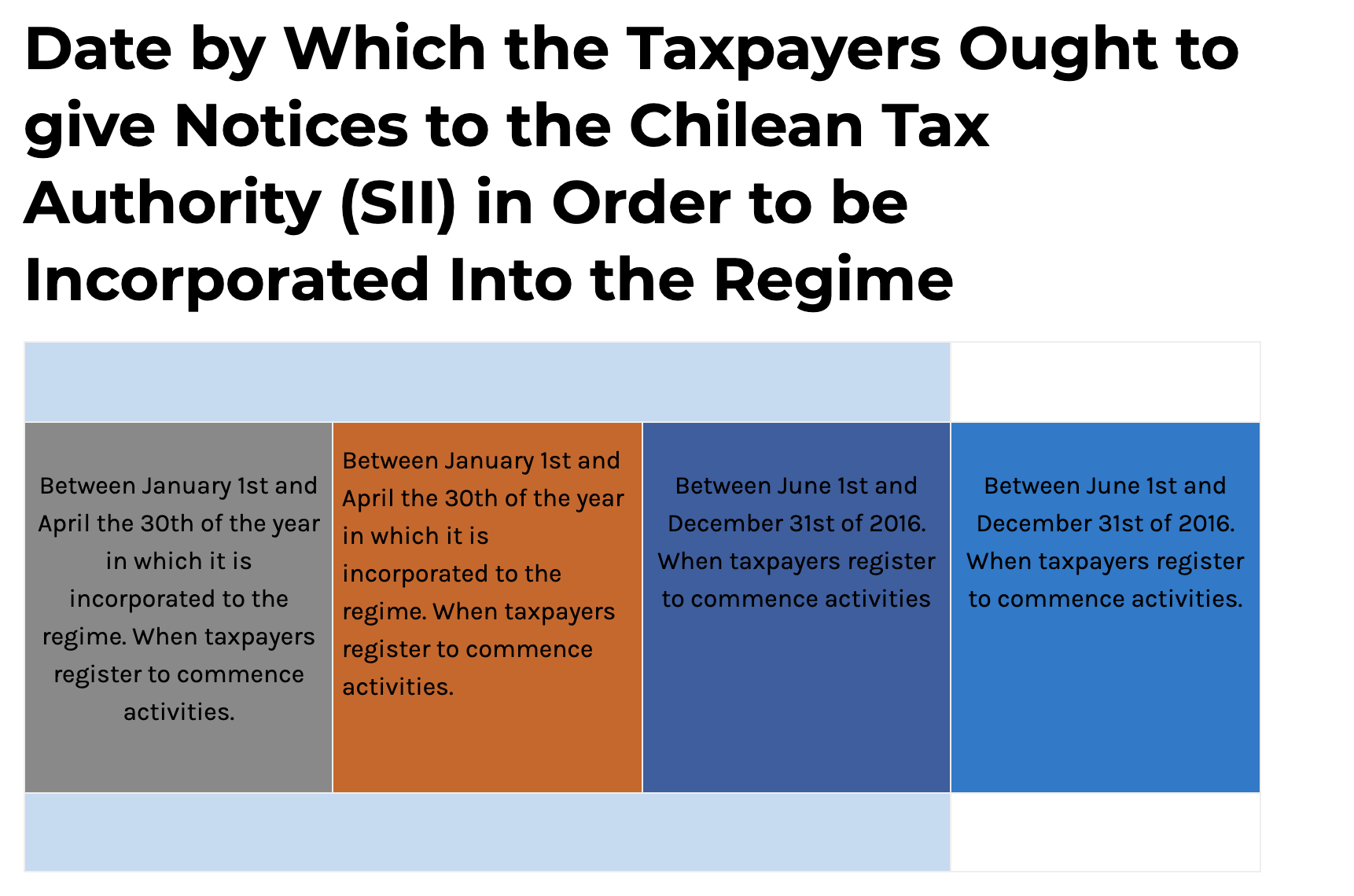

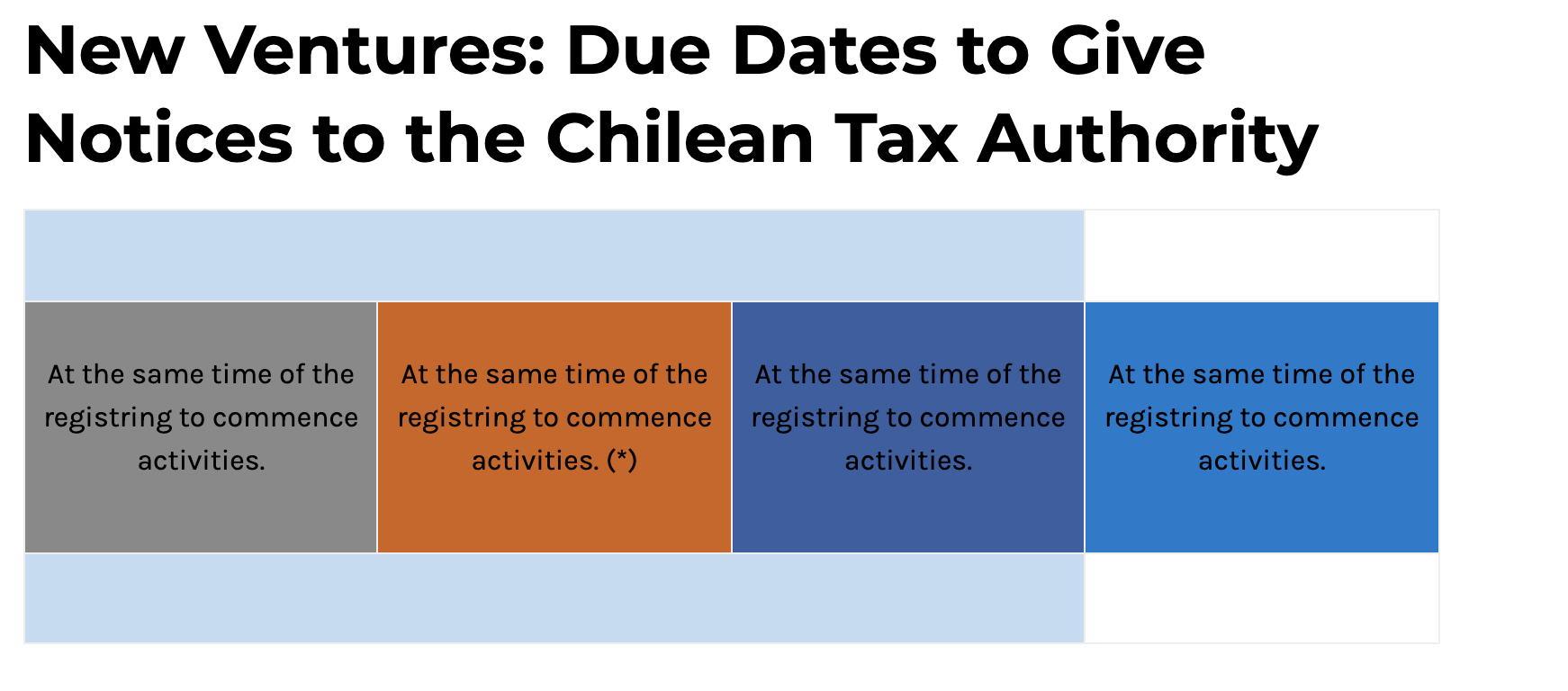

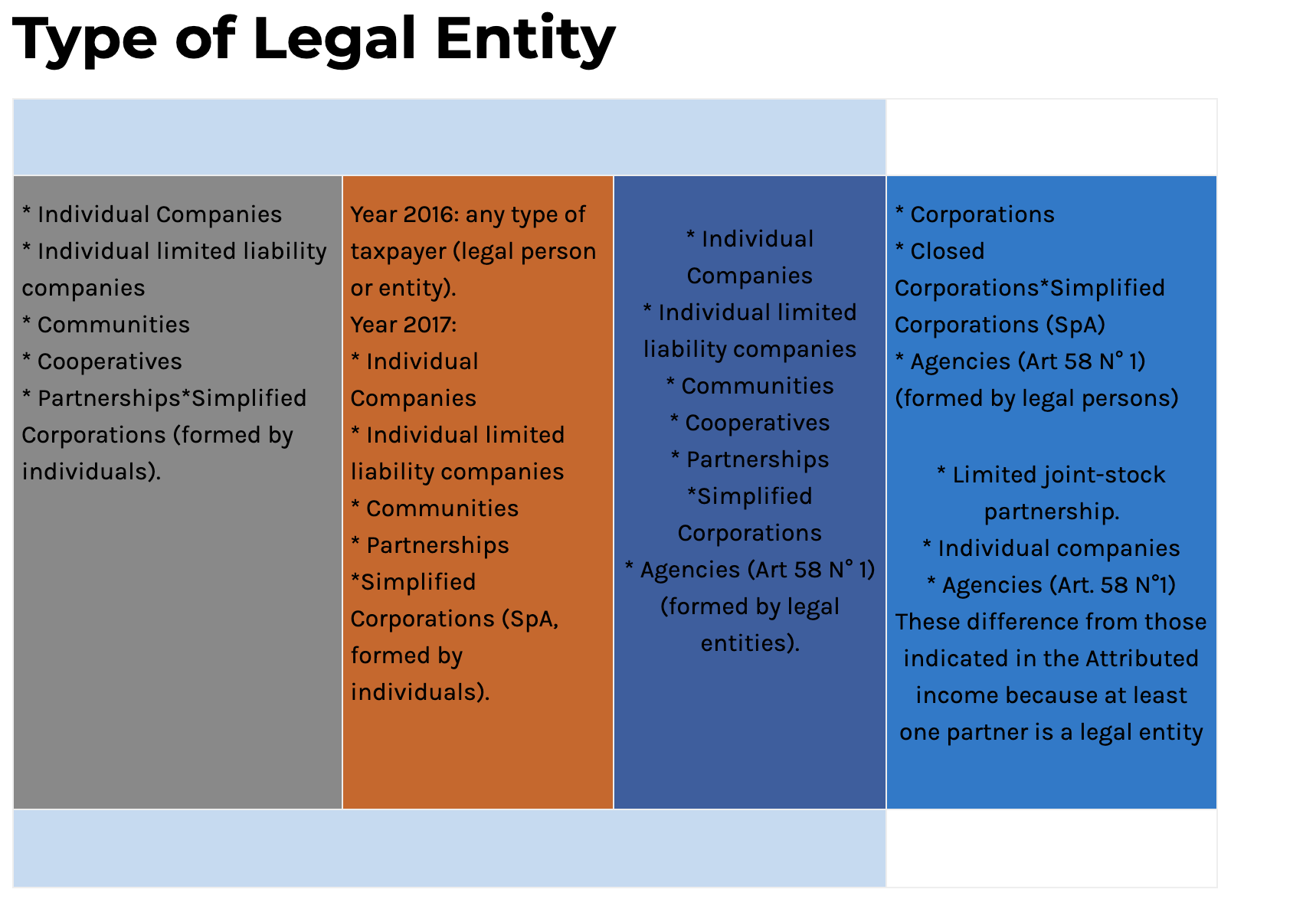

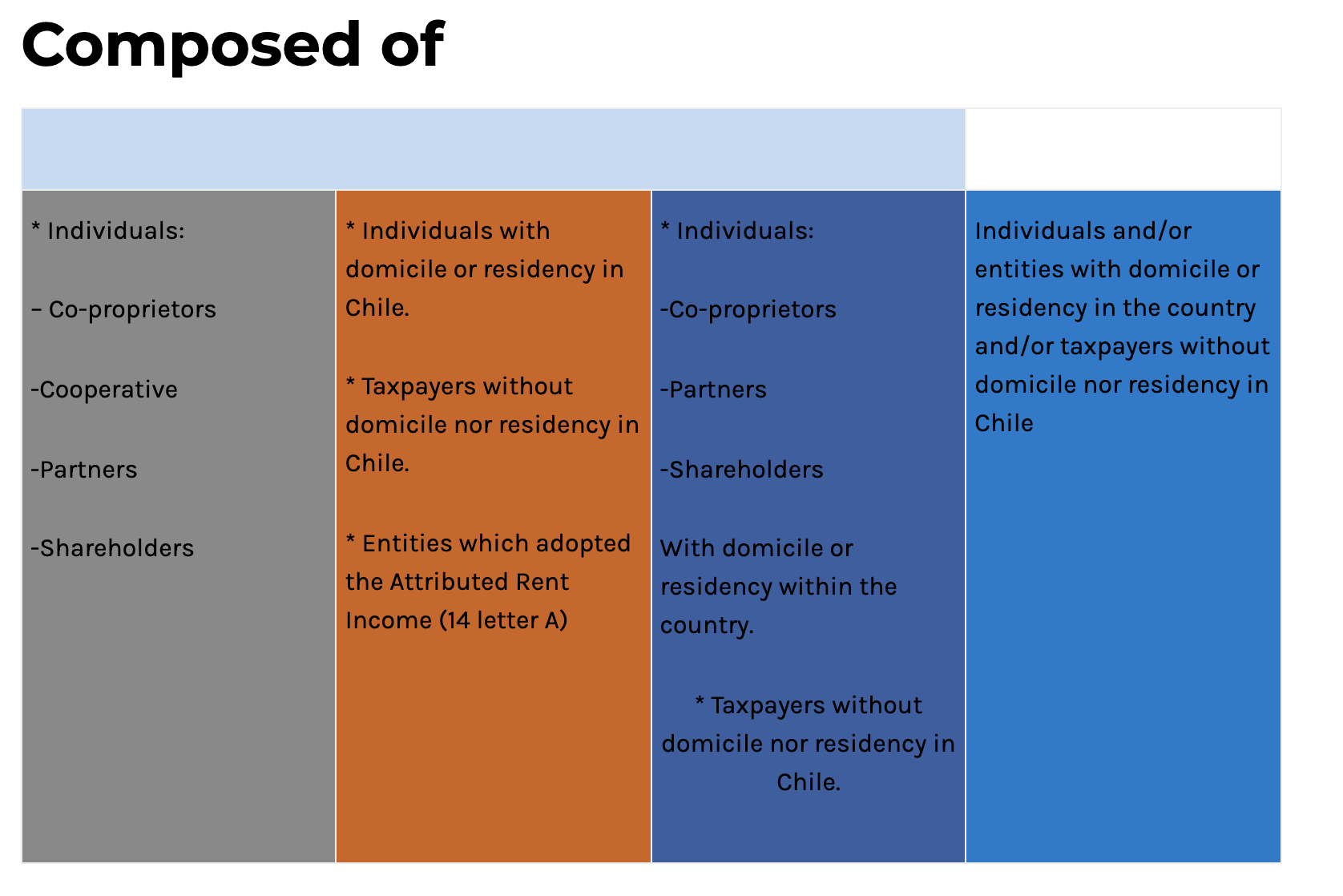

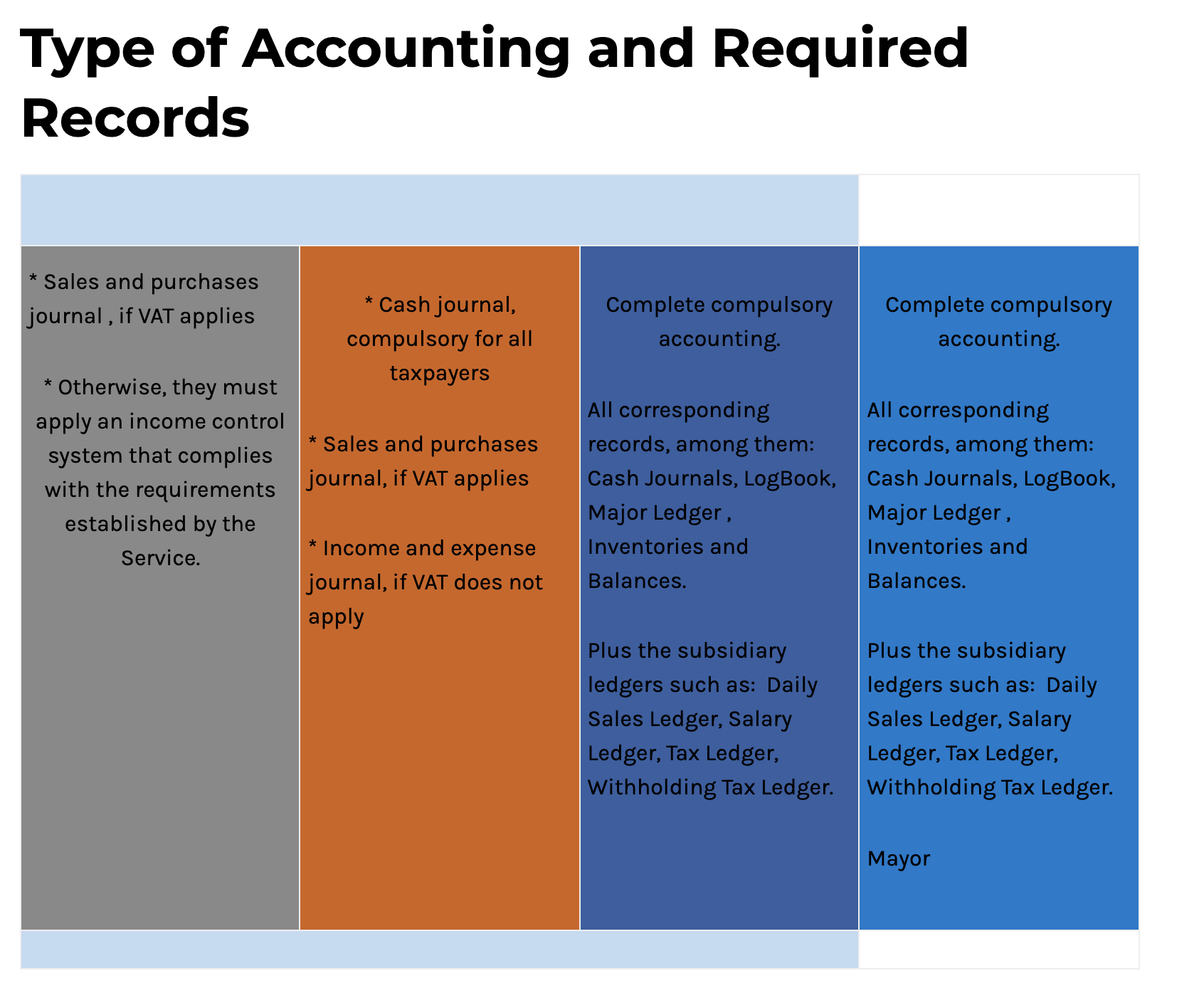

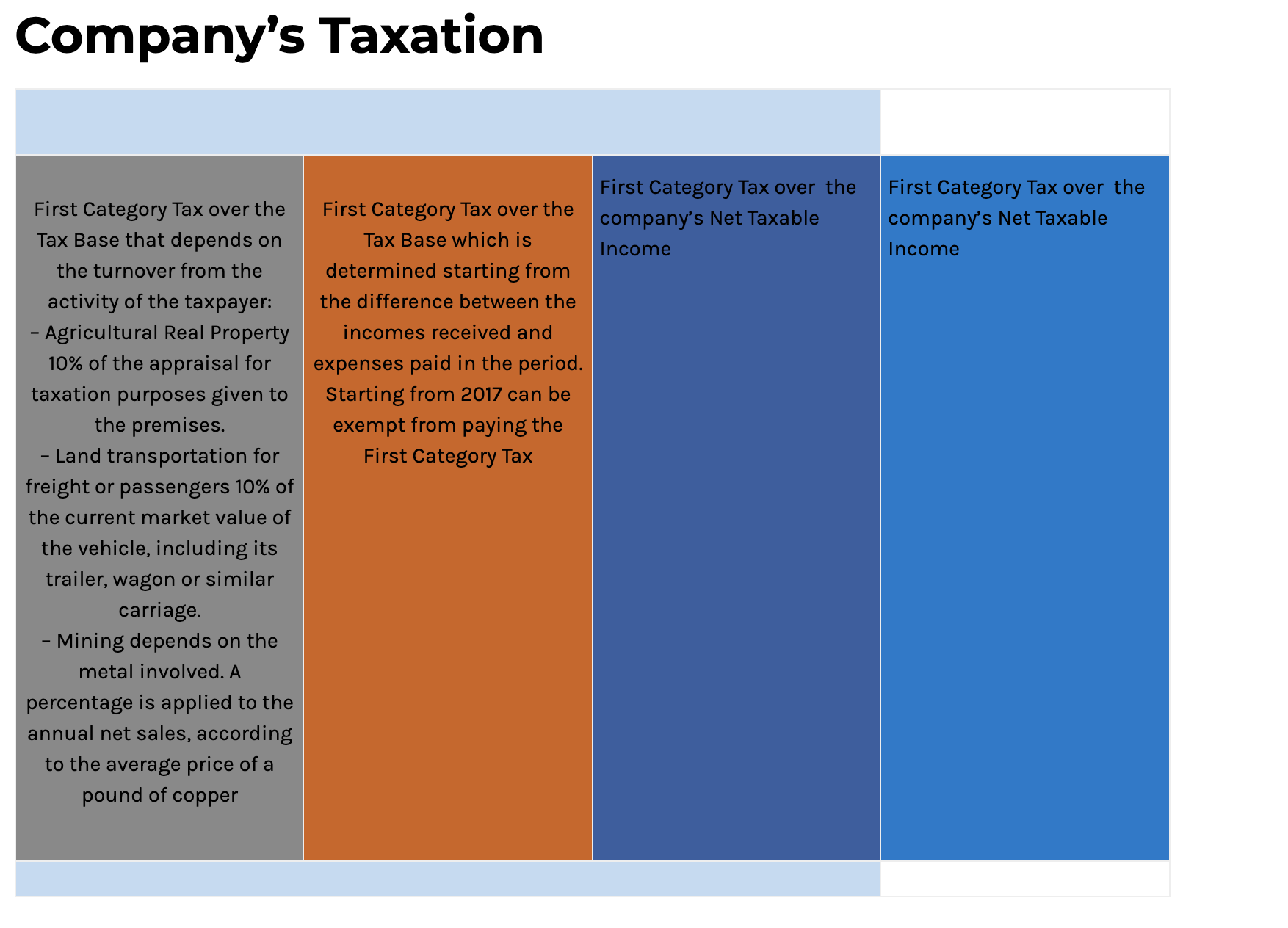

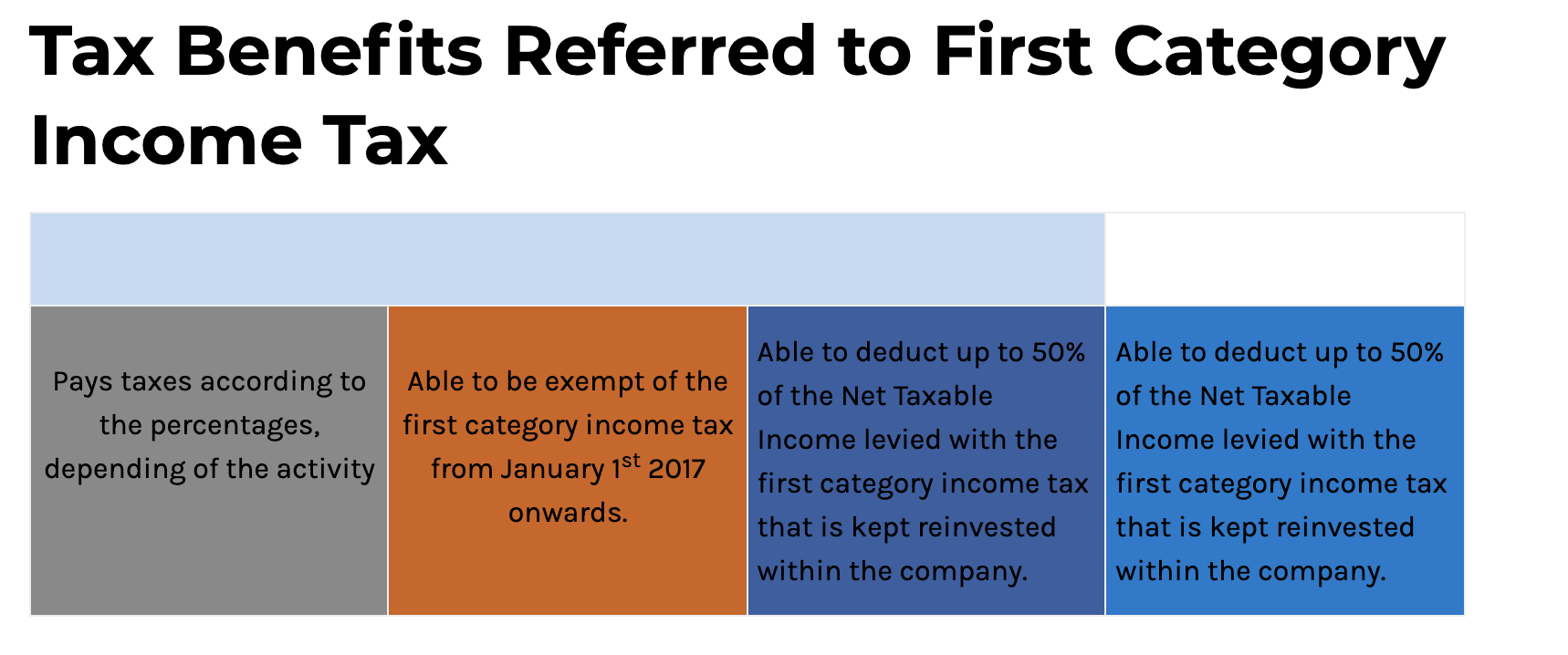

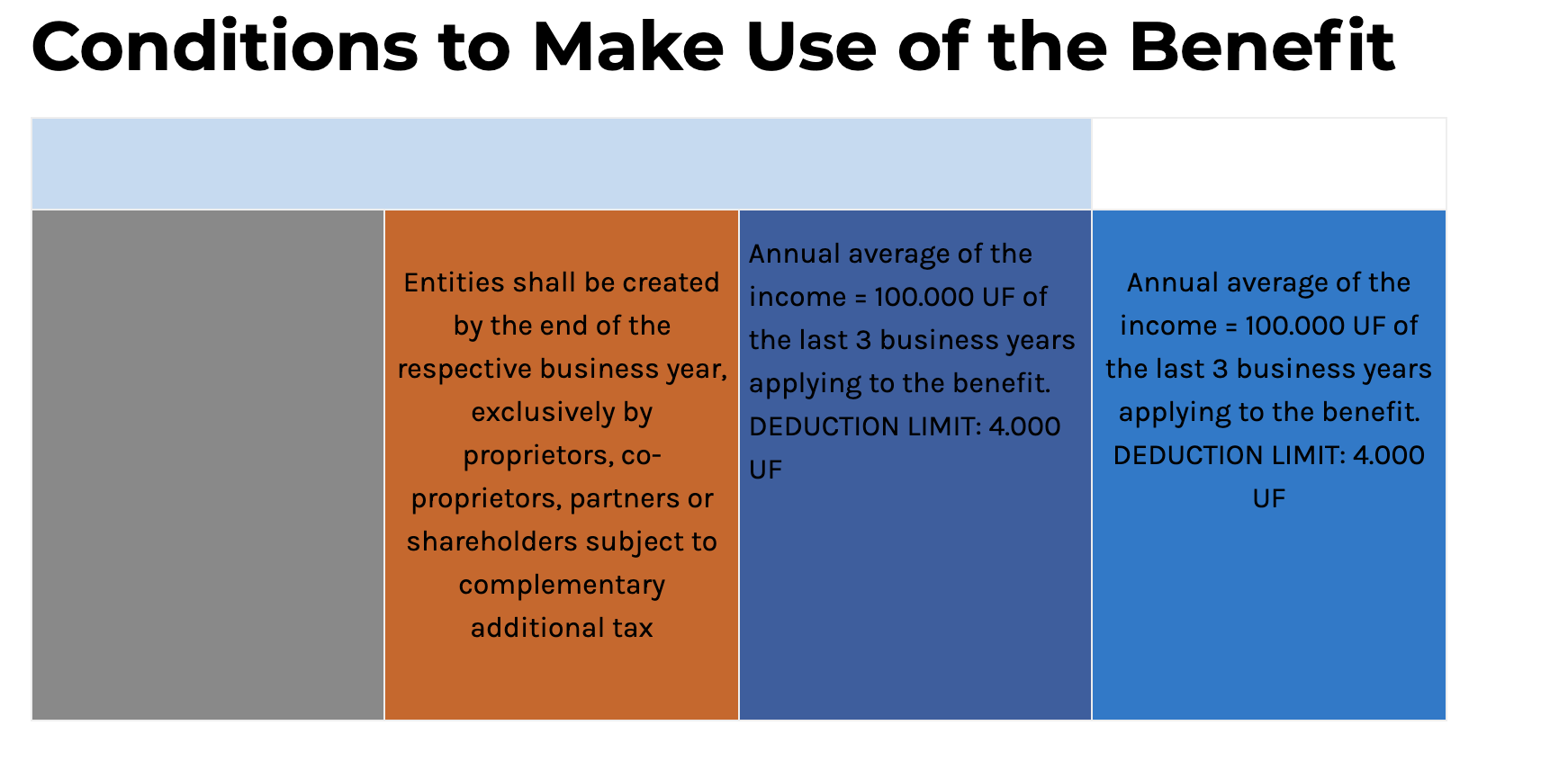

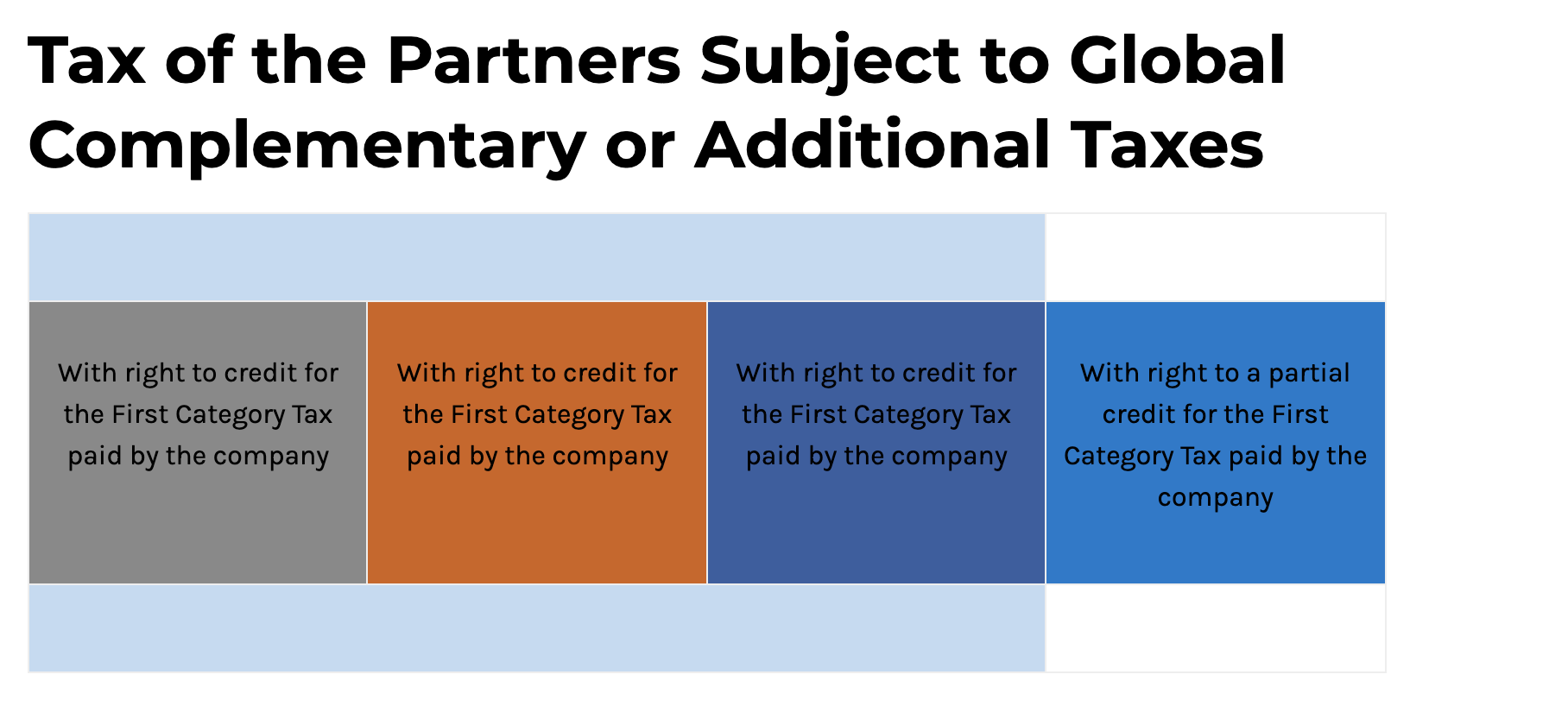

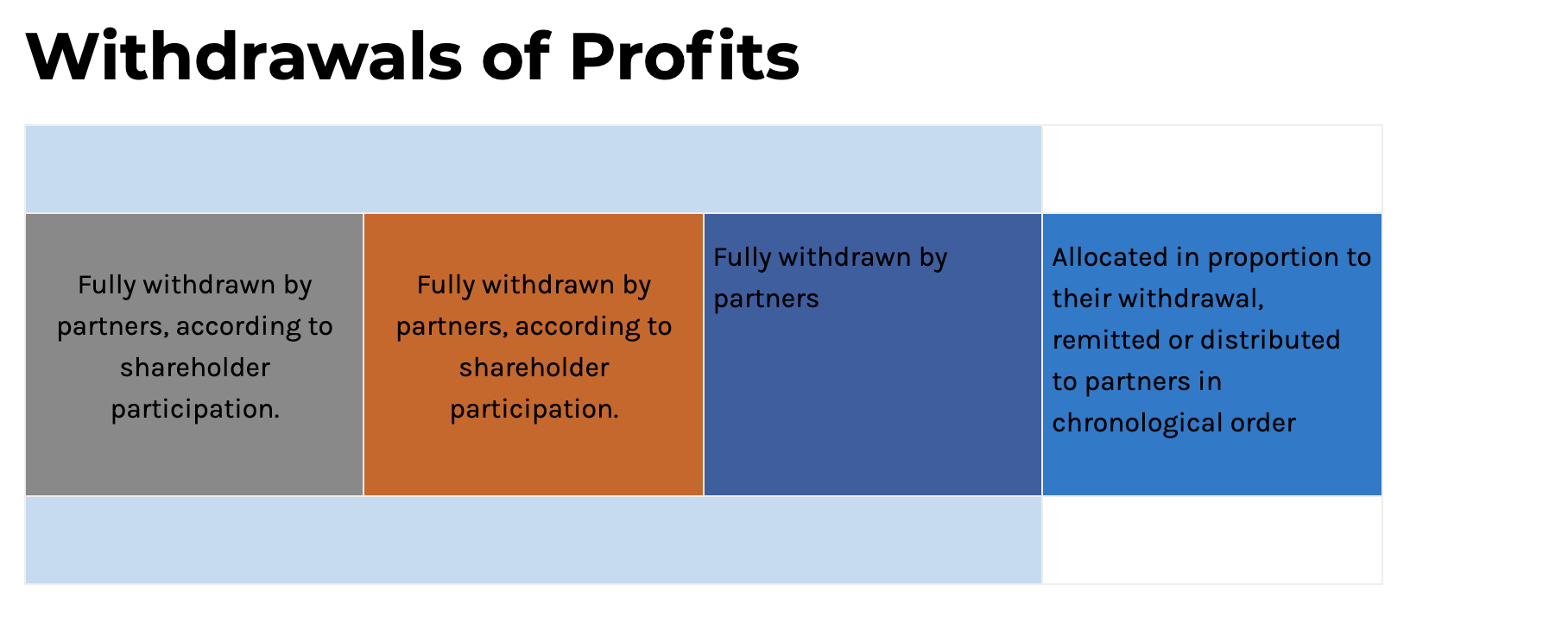

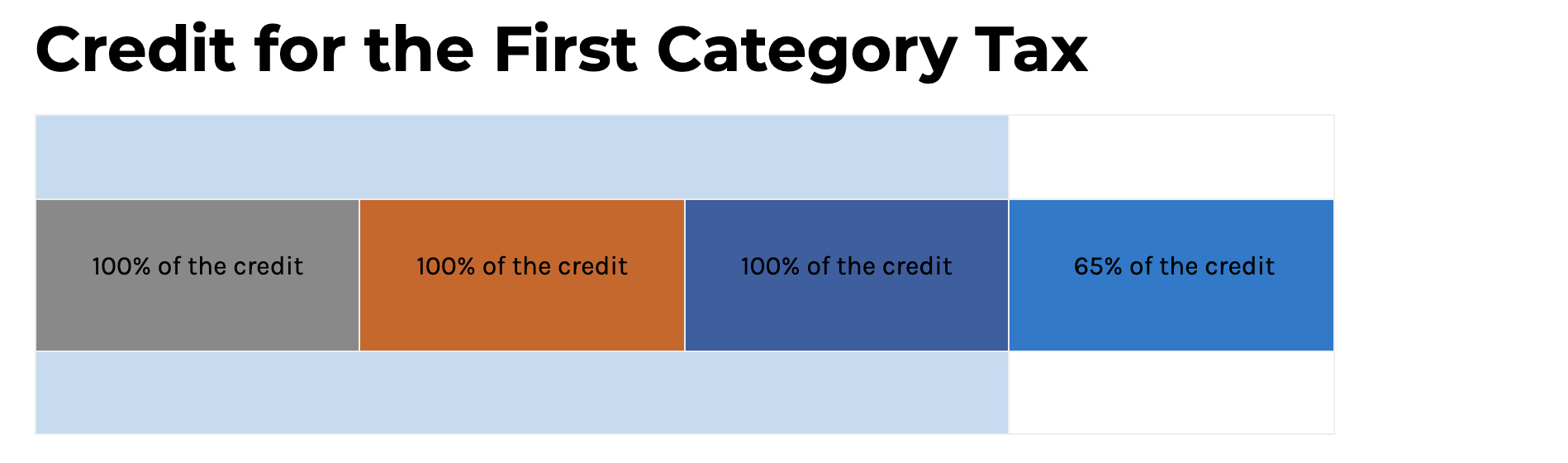

Aiming to inform our readers about the different tax regimes that will enter into force in Chile starting next year (2017), we are here making available the following chart with the information published by the Chilean Tax Authority (SII).

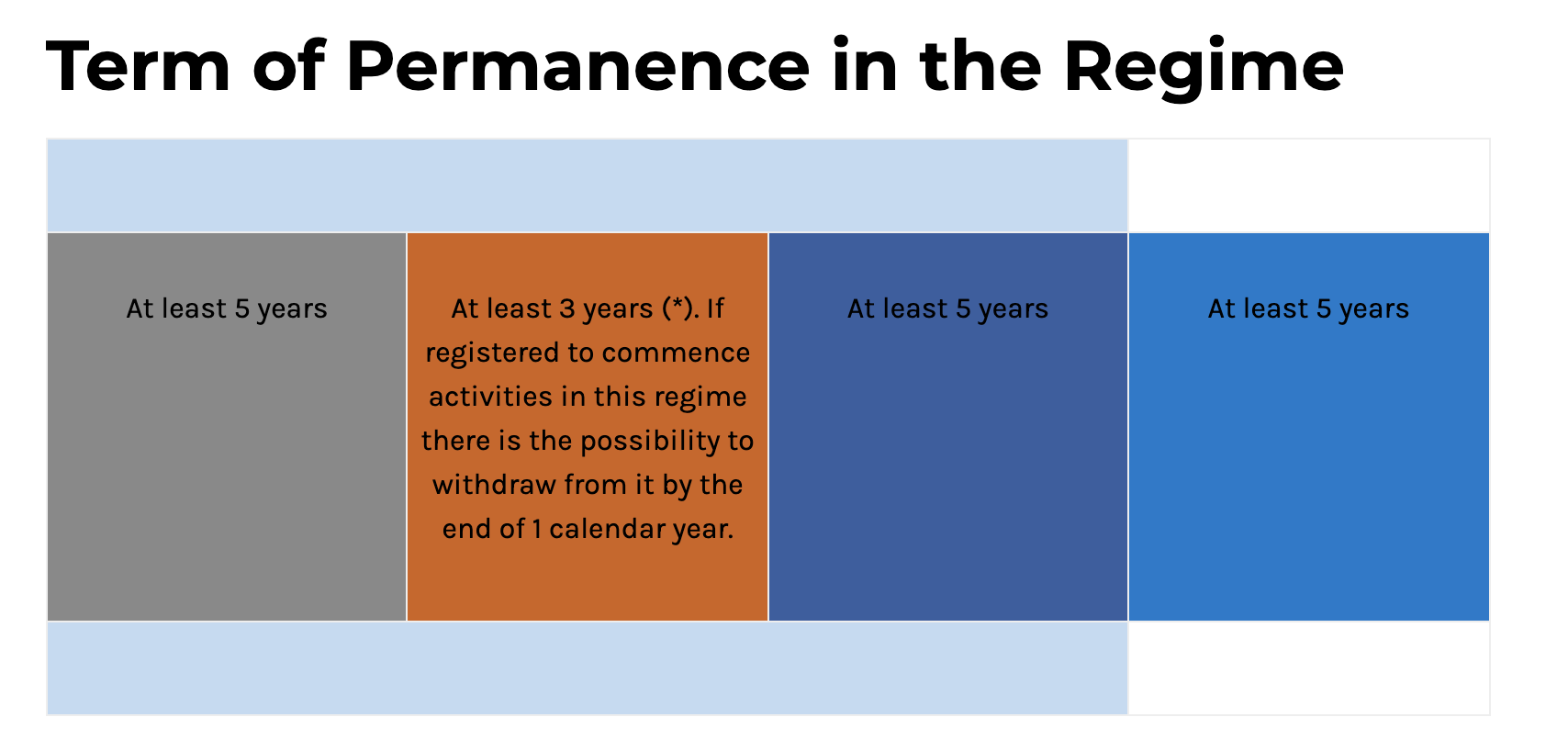

It is relevant to take into account that businesses that registered to commence activities as of July of the current year have the duty to choose one of the regimes at the very moment of their taxdeclaration. Conversely, businesses that commenced their activities in any time before such date, must choose to adopt one of these regimes before the end of the year.

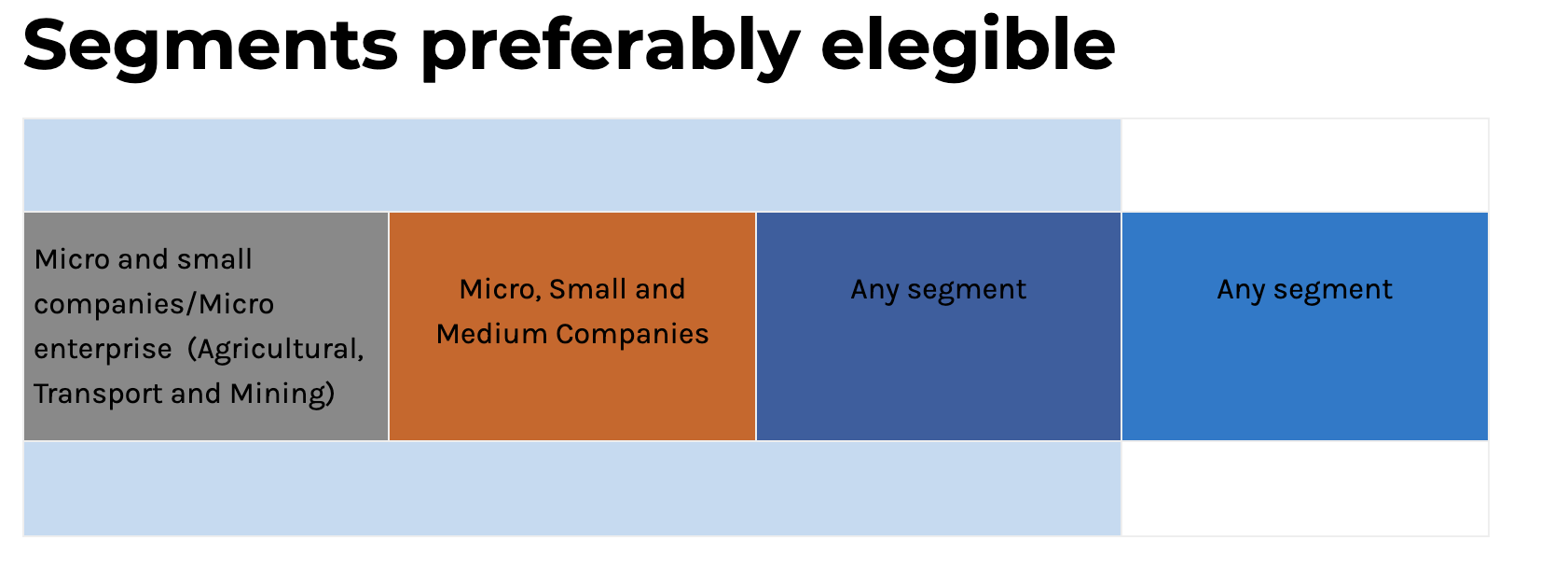

As a tip for entrepreneurs, if you adopt this decision advised by your accountant, make sure he is aware of the implications of each tax regime before adopting one. If you are starting your business (and you do not qualify for the Presumed Income Regime) it is likely that the adequate regime for you is the simplest, this is14ter.

Also consider that certain types of companies do not have the possibility of choosing.

Source: Servicio de Impuestos Internos

Santiago Henríquez C. Lawyer.

Foto: Phil Houston (CC0)