Although sometimes it may not be so clear, in the first stages of a venture, especially from the generation of the idea to the process of incorporating the company, there is a series of legal issue that is necessary to address.

Many times, the founder teams tend to postpone relevant legal decisions for later stages (for example the portions of equity of the company to be divided among the partners). Other mistake commonly made is to not put in written any agreements achieved on a founder team meeting, or to not take the necessary measures to protect those things that give the most value to the company.

This may occur by a number of reasons, as ignorance, lack of time or lack of resources, especially when the team is “bootstrapping”. These omissions may generate adverse legal consequences down the road, making it necessary to incur in higher costs in legal fees and in a huge loss of precious time at the moment where is fundamental to generate traction.

In this process we can find problems such as:

- Failure in the industrial property assignments: At the beginning the main value of the startup will be in its founder team and in the intangible assets (intellectual property) as the developed software code, the corporate image or the platform design, the unique and differentiating features, an algorithm etc. If there is no clarity about who is the owner of this intangible when the opportunity of selling the company, invite an investor to fund the business, or even offer a license of the product, it simply may be a deal breaker.

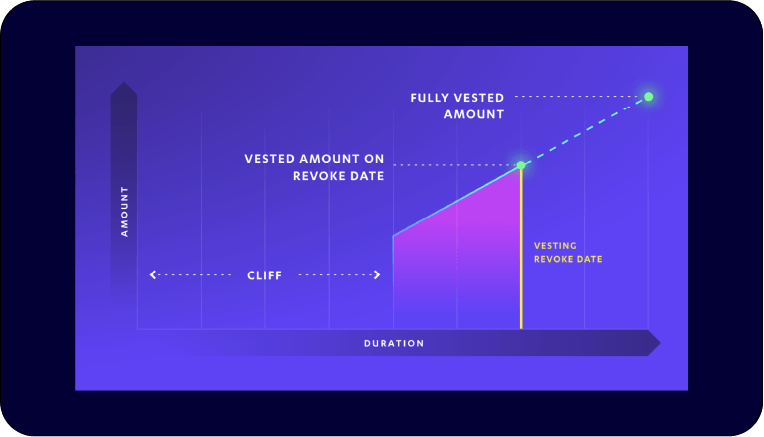

- Do not establish a vesting schedule: More often than people think irreconcilable differences are produced between the founders that makes one of them to leave the company. This situation may generate that a big percentage of the company remains “taken” in the case that the founder does not want to sell or give back his share, this is the main reason to adopt a vesting schedule (when signing the founders agreement or at the incorporation) where partners will vest a part of their shares in the company whenever certain terms or goals are met. In this way an incentive is generated for the partners to stay and work for the startup, and in case of conflict, the shares that are still unvested may be offered to someone else aiming to replace the retires founder.

- Do not perform an analysis of legal risks in the industry: another common issue is to not include in the project evaluation an analysis of the possible legal contingencies that the implementation of the business model will generate. It must be taken into account that in 99% of the situations, regulation goes one step behind than the market, which is much more clearly on innovative industries. Because of this, if the actual legislation may collide in any way with the project, or simply the situations that the startup is looking to solve is not regulated, is highly advisable to ask for an expert legal opinion. Although this will not resolve the problem itself, it will serve to reassure customers and investors that the business is viable.

Is important to evaluate every one of these subjects when the moment comes and to not let them grow after launching the startup, because many times the marketing, selling and administration process will not allow you to address this relevant issues properly.

HubLegal.cl id offering a plan for entrepreneurs in early stages, Idea – Validation Plan, created to support and protect your business since the beginning.

Santiago Henríquez C. Lawyer

Picture: Sylvain Guiheneuc (CC0)

Post previously published (in spanish) in Broota’s Blog, Crowdfunding y Red Latinoamericana de Emprendimientos.